- Home

- FinTech

Fintech Software Testing Services

It is necessary to ensure the highest quality of your software solution to provide user satisfaction and strengthen your leadership positions in the FinTech industry.

Our team helps financial companies manage risks, unlock their potential, and turn ideas into effective FinTech solutions.

How Is Luxe Quality Doing With That?

Learn about Luxe Quality's fintech software testing services. Here are some key metrics:

2k+ hours

Total number of working hours

4 projects

Successfully completed

5 months

Average project duration

Case Studies

FULL CASE STUDY

Hodlnaut

Singapore

•Mobile

Implementation time: May 2021 - Jul 2021

About project: Hodlnaut is a financial platform specializing in cryptocurrency services.

- Manual, Automation, API, Functional, Smoke, Regression testing and Usability testing;

- Automation testing - TypeScript + WebdriverIO and API testing - Postman.

Technologies: typescript, browserstack, webdriver, postman

FULL CASE STUDY

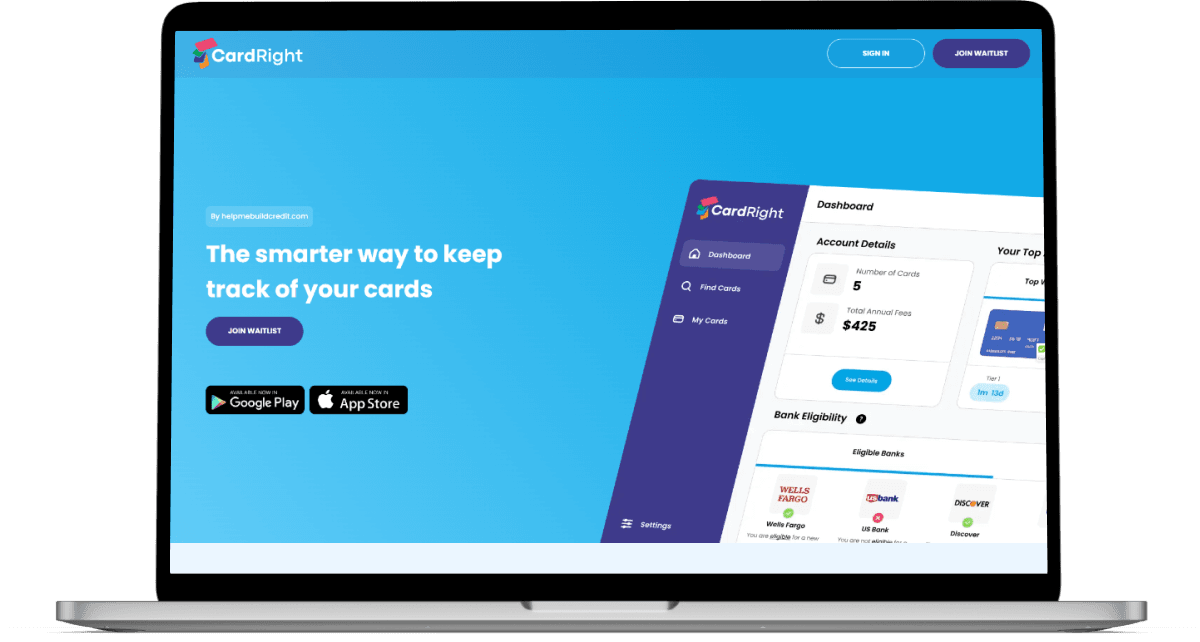

CardRight

USA

•Web, Mobile

Implementation time: Apr 2023 - Present

About project: CardRight is a fintech company based in the USA specializing in financial services.

- Manual, Automation, Regression, Smoke Testing

Technologies: typescript, playwright

FULL CASE STUDY

Fundflex

Lithuania

•Web

Implementation time: Jun 2021 - Present

About project: Fundflex offers comprehensive online loan software.

- Automation, Functional, Usability, Cross-browser testing

Technologies: javascript, webdriver

We offer FinTech testing services for

E-banking solutions

Loan applications

Audit companies

Startups in the field of innovative financial solutions

Investment applications

Tax management

Portals for trading

Insurance

Online payment systems

Blockchain platforms

The main types of fintech project testing

These types of testing are critical when testing virtually every fintech project.

Performance testing

Fintech applications must run at high speeds and provide minimal latency to ensure the reliability of financial transactions. Performance testing determines how well the system meets these requirements.

API testing

Fintech testing services often interact with other systems through APIs. This type of testing includes verifying the correctness of data transfer with external systems and confidence in their reliability.

Penetration testing

Since fintech applications deal with financial transactions and sensitive information, ensuring security is extremely important. This type of software testing for banking is used to identify possible vulnerabilities and guarantee the protection of data and the system as a whole.

Workflow

Planning and preparation

1. Requirement analysis: Before starting testing for fintech enterprises, testers should carefully analyze the functional and non-functional requirements of the product.

2. Creating a test plan: Define the main test scenarios, the types of tests that will be conducted, and the required resources.

3. Selection of tools: The necessary tools for test automation, performing performance tests, ensuring security, etc., are selected.

4. Preparation of functional tests: Scenarios are developed for testing basic financial operations, such as fund transfers, withdrawals, and currency conversion. Test documentation is also created.

5. Preparation for security testing: Test scenarios are developed to check vulnerabilities for SQL injections, XSS attacks, and other attacks. Test documentation is also created.

6. Preparation for performance testing: Scenarios for load and stress tests are planned. Test documentation is also created.

Execution of tests and analysis of results

1. Execution of tests: In the process of execution of tests, a systematic analysis of the results of specific test trials is carried out to identify and document the identified bugs.

2. High-level testing: After the entire low-level testing process is completed, high-level testing is performed, and the entire system is analyzed to determine whether it can be presented to users.

3. Data collection and analysis of results: Various data are collected, including performance metrics, screenshots, etc. Problems are identified, vulnerability analysis is performed, and performance is evaluated.

4. Documentation: Reports are created that describe the testing process, results, recommendations, and other important information.

Editing, regression testing, and post-test support

1. Bug fixing: After analyzing the test results, developers carry out bug fixing to eliminate previously discovered bugs.

2. Regression testing: Regression testing is performed to check whether the new code affects the stability and functionality of the existing system, ensuring its reliability is preserved.

3. Post-Test Support: After the software product is put into operation, ongoing support is provided, including resolving new issues and user requests to ensure the smooth operation of the product.

Why Choose Luxe Quality as a Software QA company

Quick start

We can start working on your project within 24-72 hours from the moment of signing the contract.

Free trial

We offer a free 40-hour trial. Evaluate our services and see how we work.

QA/AQA specialization

We are focused on providing quality fintech software testing services, and we are proficient at it.

Top-notch technologies

We can automate the most challenging scenarios using modern technologies and find unexpected bugs.

Team Players

Our specialists will fully immerse themselves in your project and provide comprehensive reports.

Own training center

Our engineers have up-to-date technologies and can find an approach to any project.

40 hours of free testing

Luxe Quality has a special offer tailored for potential long-term customers who are interested in starting a pilot project.

We are offering our software testing and QA for free for the first 40 hours.

Our Clients Say

Get in touch

Our workflow

Now: Just fill out our quick form with your project details. It’s easy and only takes a minute.

In a Few Hours: We’ll assess your information and quickly assign a dedicated team member to follow up, no matter where you are. We work across time zones to ensure prompt service.

In 1 Day: Schedule a detailed discussion to explore how our services can be tailored to fit your unique needs.

Following Days: Expect exceptional support as our skilled QA team gets involved, bringing precision and quality control to your project right from the start.

FAQ

Fintech software testing services testing help ensure these criteria by identifying and fixing bugs and vulnerabilities before they are deployed in a production environment. Because every mistake can lead to financial losses and legal consequences, money transactions always require special attention from users, investors, and regulators.

Yes, automation is often used for regression, performance, and security testing. Luxe Quality has the latest and most effective technologies to facilitate testing on the project.

Functional, security, performance, integration, and compliance testing are usually performed for the fintech industry. Usability testing is also important in this field.

Different standards and regulations may apply depending on the region and type of financial transaction type, such as GDPR, Dodd-Frank, PSD2, and others.

Yes, we have experience in testing blockchain projects and can ensure high quality and security.

Yes, we specialize in testing mobile applications and can ensure their reliability, security, and performance.